So You Want to Design A Direct Cash Transfer?

- Home

- So you want to design a Direct Cash Transfer?

By: Babs Roberts

Senior Advisor, Programs & Policy for the WA Economic Justice Alliance

As Matthew Desmond states in his book, Poverty, by America, “Poverty isn’t simply the condition of not having enough money. It’s the condition of not having enough choice and being exploited because of that.”

Direct cash transfer programs (DCTs) can provide both – money and choice. These flexible resources allow individuals and families choice and the ability to meet their most basic needs, like food, housing, and other necessary supplies for daily life.

Available evidence bears out that direct cash transfers are one of the most effective policy tools we have in tackling poverty and achieving economic wellbeing.

Read More about Direct Cash Transfers

As policy practitioners consider harnessing this tool for the benefit of the public, the particulars of design matter. That’s why we’ve compiled a list of critical areas for consideration to support the design of effective DCTs:

- Targeted or Universal?

- Conditional or Unconditional?

- One-Time or Recurring?

- Protecting Other Public Benefits

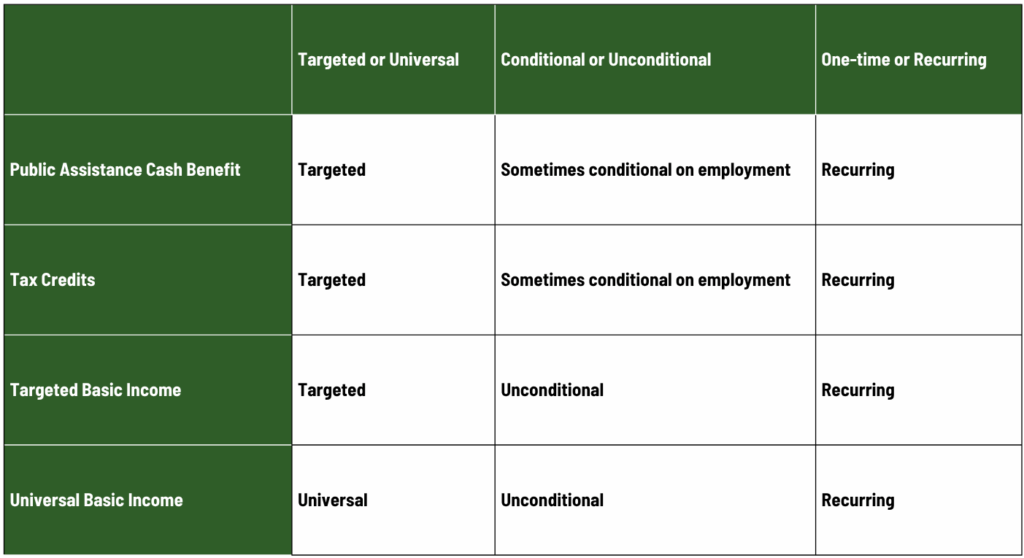

Each DCT has a character of its own, based on its design. Here’s a look at some of the most popular designs:

Targeted or Universal?

Whether to apply a benefit to everyone, or only people within a targeted category or income level is probably the easiest to answer for most people. Some claim that universal basic income programs are more efficient than traditional welfare programs because they eliminate the administration costs of means testing and ensure that everyone who needs the benefit will receive it. However, concerns about budget, inflation, and use of government funds to pay people living well above the poverty threshold tend to lead program designers to favor targeted programs over universal.

But, who is targeted and how they are targeted matters. Program designers may need to consider questions like who needs the transfer most, or which population(s) are you attempting to support? Additionally, once a target population is identified, designers will need to consider what administrative mechanisms will be needed to identify and qualify eligible recipients—tax records, applications, categorical eligibility?

Lastly, when targeting a recurring DCT to a certain income threshold, the thresholds should be designed so that clients avoid public assistance benefits cliffs and able to reach defined program outcomes. This usually requires the benefit to taper off across a range of incomes.

Conditional or Unconditional?

The choice between conditional and unconditional cash transfers significantly influences program outcomes:

- Conditional Cash Transfers link financial assistance to performing specific behaviors, such as participating in job training, a child’s school attendance, or regular health check-ups. While these programs can drive desired outcomes, such conditions, by design, may introduce barriers that limit participation.

- Unconditional Cash Transfers offer recipients the freedom to use funds as they see fit, without behavioral stipulations. In Tacoma, WA the Growing Resilience In Tacoma (GRIT) program provided $500 monthly payments to 110 households. Recipients used the funds to pay off debts, improve credit scores, and enhance financial stability, highlighting the positive impact of unconditional cash transfers on economic well-being.

One Time or Recurring?

The cadence of a DCT payment may also need to be considered. Annual tax credits (often considered a DCT) may be considered one-time payments and still have very positive impacts to recipients. However, they are only annual. Recurring payments, payments delivered on a set schedule (i.e. monthly, quarterly), are also beneficial as recipients know the payment amount and when it will be available – therefore are able to anticipate it in their budgeting. However, recurring payments are more likely to be considered income for purposes of public assistance programs.

Protecting Other Public Benefits

As stated above, the cadence of the payments from a DCT may be an issue. For example, in most programs, predictable, recurring payments must be “counted” as income for eligibility purposes, but non-recurring or one-time payments may be excluded. For instance, in the Medicaid program, this kind of cash “gift” is countable when it is recurring (there are some caveats to this).

And, unfortunately, for some programs there is no way to exempt DCT from the eligibility determination process, like in the case of Social Security Disability Insurance. Understanding the impact a DCT may have on other supports people are receiving will be an important component of a DCT design.

The WA Economic Justice Alliance has created a Protecting Public Benefits Matrix for those interested in designing a direct cash pilot in Washington state. The matrix is a guide to designing direct cash transfer programs so they protect public benefits as much as legally possible. For best results, we encourage you to connect with each public assistance program area, discuss your design ideas and seek their guidance and collaboration. As always, the Economic Justice Alliance team is ready to help make those connections!

Conclusion

Designing effective Direct Cash Transfer programs requires a thoughtful approach that considers the needs of recipients, the objectives of the program, and the interplay with existing public assistance systems. By addressing key considerations such as targeting, conditions, payment structure, and the protection of other benefits, policymakers can create programs that empower individuals and families to achieve greater economic stability and well-being.

As the field of cash transfers continues to evolve, ongoing research and dialogue will be essential to refine and improve these programs, ensuring they meet the diverse needs of communities across the nation.